How to check LIC policy status without registration online | Check LIC Policy Status by SMS without Registration | LIC SMS Services | licindia.in

LIC (i.e life insurance corporation of India) is the largest insurance company in India. The LIC has collaborated with over 245 insurance companies that are offering their services to millions of customers in India. The life insurance corporation of India has been established in 1956. The company has a variety of policy which suit for customers of all ages from Education, health to property insurance, LIC ensure that their customers are safe, well cover, and enjoying the policies.

Table of Contents

LIC Policy Status

LIC has implemented various policies to sell under certain conditions. The company has grown its technology and adapted a new digital system for its clients. Now any person who wants to buy as a new policy or check their policy status, without visiting the branch offices. With the help of the online portal of LIC i.e https://licindia.in customers can check every detail related to LIC policy on their mobile devices. In this article we will solve your query i.e how to check LIC policy status without registration online?, you can check LIC policy status by following simple steps.

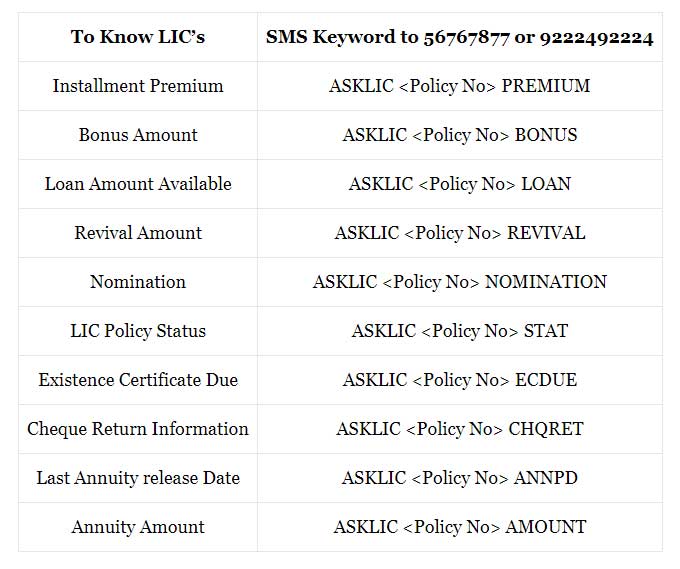

How to check LIC Policy status without registration Online via SMS?

Customers of LIC can check their LIC policy through SMS. The company has offered LIC SMS services to make the checking policy status process easy. to check LIC policy status without registration you need to follow the easy steps given below

- Open SMS option on your mobile

- Click on compose SMS ( send a new message)

- Type ASKLIC XXXXXXXX STAT ( where XXXXXXXX will be your Policy Number)

- Now send this message to 56767877 through your registered mobile number

- Now you will receive an SMS with the status of the LIC policy, if your mobile number not registered with the policy then you will receive an error message.

List of LIC SMS Services is given below

How to Check LIC Policy status without registration Online via LIC web Portal?

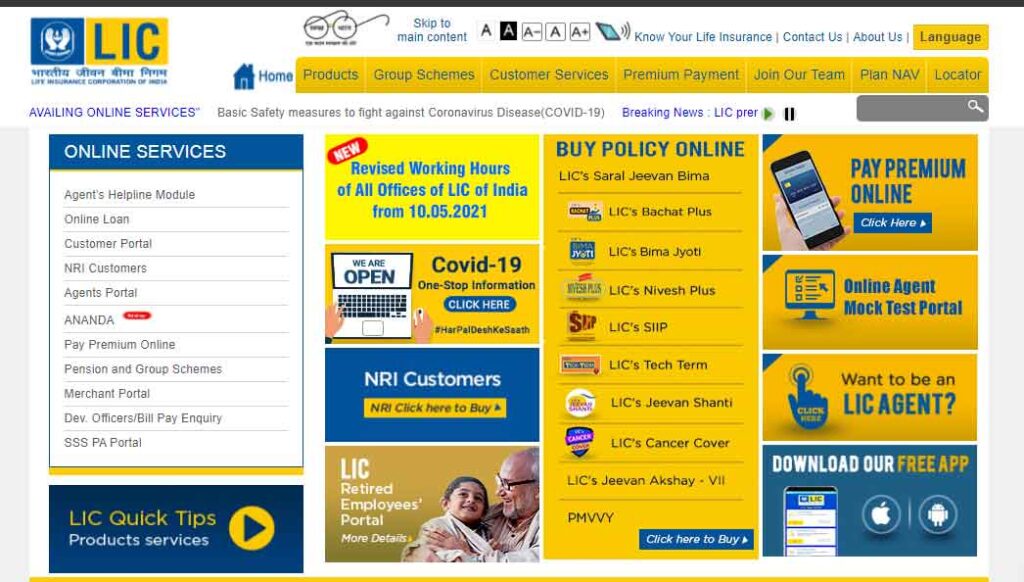

The online process for registered users

Registered users need to visit the official website i.e https://licindia.in to various details such as check the status of any LIC policy. The payments, requests, bonuses, and schemes. to Check LIC Policy status without registration Online you need to follow the easy steps given below-

- Firstly you need to visit the official website of the e-service LIC policy, homepage will open as shown below-

- Here you will see 2 options i.e –

- New user

- Registered user.

- Click on registered user now a new pop-up window will open where you need to enter your login credentials i.e-

- User ID/Email/Mobile number

- Password

- Date of Birth

- Now you will log into your LIC account page, where you will see different policy options.

- Click on the Policy Status button.

- Here you will be shown all the policy accounts, click on the policy of your choice to add a policy that is not listed on your account.

- Click on the enroll policy option using the LICs e-service tools.

- Now you can check the policy status just by clicking on the policy number from the given list.

- Finally, all the details such as policy name, policy term, table number, premium date, and the total sum assured will appear on your screen.

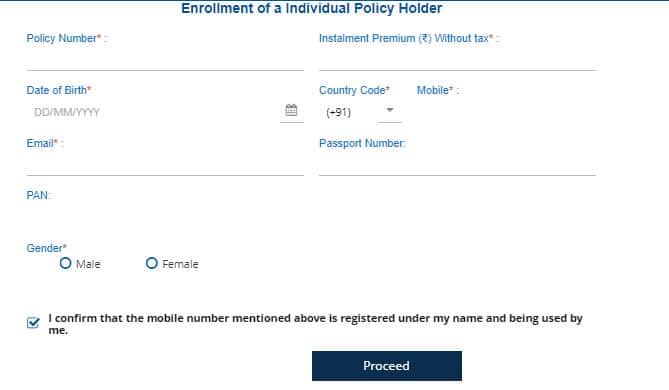

LIC Policy Status Online Check for new user

If any new users want to enroll on The e-service portal for LIC policy cover. By following the easy steps given below.

- Firstly you need to visit the official website of the e-service LIC policy, the homepage will open.

- Here you will see 2 options i.e –

- New user

- Registered user.

- Click on New User now a new pop-up window will open where you need to enter correct details about your policy i.e-

- Policy number

- Installment premium paid (without tax).

- Date of Birth ( DD/MM/YYYY )

- Pan Number (Optional)

- Passport number (Optional)

- Registered mobile number

- Registered email address.

- Gender

- Check your details carefully then click on the Proceed Button. ( Note – the system will delete the invalid information automatically within five working days.)

- Now you will get an option to create your user id and password, then confirm your password then click on the submit button.

- With all the details you created i.e user name and password the new user can log in to their policy account to check the status and other insurance activities.

How to enroll in your LIC policy?

- Firstly you need to visit the official website, the page will show you a pop-up request, “do you have any LIC policy” now click on the “yes tab.

- It will redirect you to an online LIC policy enrollment form.

- Here you need to all the required details such as

- Name

- The premium to pay,

- Policy number for each policy etc

- Now take a printout of the form after the complete filling for your reference.

- You can download the policy number later after completing the registration process as well.

- After filling the form you need to submit it to the nearest branch LIC.

- After submitting the form LIC branch office will provide you an acknowledgment letter with your user id.

- The whole process will be verified when all the necessary documents and details fulfill the LIC policy agendas.

LIC Surrender Value Calculator

You can calculate the LIC surrender value after 3 years of your LIC policy through the LIC surrender value calculation formula given below:

The Basic sum assured (Total number of payable premiums/Total number of premium paid) + Total bonus received x surrender value factor.

To understand this let’s take the case of LIC Jeevan Anand policy if we apply the LIC surrender value after 3 years of the LIC policy, which will be equal to 30% of all premiums except the premiums which are already paid of the first year plus the vested bonus. But, the accident benefit will not be considered in calculating the surrender value.

Note – Bonuses can be defined as the additional amount paid in cash at the time of death or after completing the tenure of the policy.

Now back to the case take of LIC policy assume it has been beginning in 2010 for 15 years.

- The basic sum for the assured for this LIC Policy is RS 4 lakh with an annual premium of Rs.30,192/-

- Total Bonuses collection Rs.70,000/-

- Let’s assume that you had paid 5 premiums,

- So your policy surrender will be 30 percent (5*30,192) + final bonus in today’s term

- In this example the sum has been applied for five years, if the users had paid more premiums than five years then there will be a different surrender value but the same formula will be used.

Download LIC policy status app

LIC Customer app is available on Playstore and Apple apps store

You can download the LIC Customer App from the link provided below-

LIC Customer App for Android Mobile Users

LIC Customer App for Apple mobile Users

Note: For more information visit https://www.licindia.in

Keep Visiting How To Fill for more updates.

FAQ

How to check LIC policy status without registration online via SMS?

You can check the status of the LIC policy via simple SMS to 56767877 from your registered mobile number.

The format of SMS – Type ASKLIC XXXXXXXX STAT ( where XXXXXXXX will be your Policy Number)

What is the LIC customer care number?

LIC customer care for India is 022-6827-6827 (toll-free)